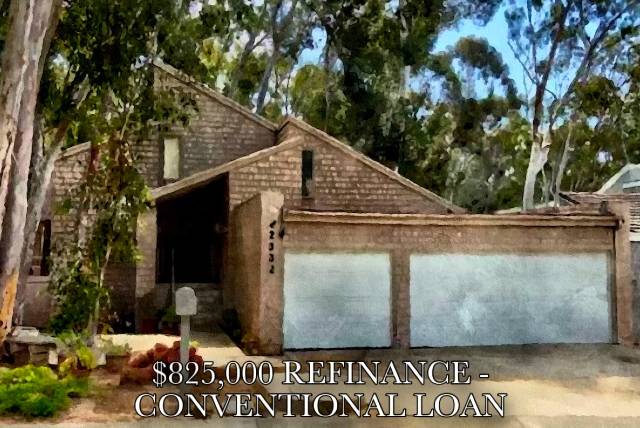

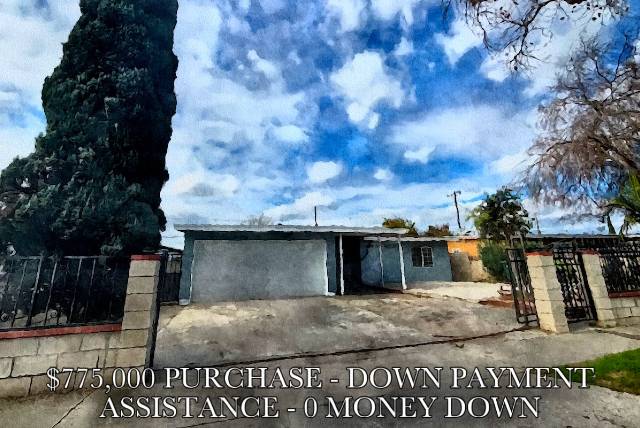

Recent Closings

Our Resources

There are a large number of home loans and programs available with new programs arriving each month. Explore the list at right, where you’ll find complete details of various home loan programs.

Our Focus is on You

With Jackie Barikhan leading the Summit Lending team, our focus is simple … helping you find the right home loan with confidence and clarity.

Through our strategic network of lending partners, we routinely close even the most complex deals at some of the most competitive rates in the market.

Combined with our direct lending capabilities, this gives us the flexibility to deliver unique, customized mortgage solutions to fit your financial goals.

Whether you’re a first-time homebuyer, self-employed borrower, or looking for a jumbo or reverse mortgage, our team brings over 20 years of experience and the tools to get it done, even in today’s challenging lending environment.

Loan Programs Designed for Every Stage of Life

Traditional Loans

• Purchase, Refinance, Second Mortgage and HELOC solutions

• Loan amounts up to $10 million

• Low down payment Jumbo loans, as little as 10% down

• 1-year tax return programs for qualified borrowers

• First-time homebuyer programs, including Bank statement loans, FHA and VA 100% LTV (0% down) options\

👉 Learn more about Conventional and Jumbo Loans in California.

Bank Statement Loans

Perfect for entrepreneurs, business owners, and self-employed professionals.

• Qualify using bank deposits as income – no tax returns required

• Flexible underwriting designed for self-employed borrowers

• Ideal for freelancers, consultants, and small and large business owners

👉 See how our Bank Statement Loan Programs help self-employed borrowers qualify.

Stated Income Loans

A flexible loan option designed for borrowers with non-traditional income documentation.

• Qualify based on stated income rather than tax returns or W-2s

• Great for commission-based professionals, real estate investors, and business owners

• No income verification required – approval based on credit strength, assets, and property value

• Available for primary residences, second homes, and investment properties

• Competitive rates with flexible loan structures

Stated income loans are ideal for financially strong borrowers who can demonstrate the ability to repay, even if their income doesn’t fit the conventional mold.

👉 Explore our Stated Income Loan Options for self-employed and investor clients.

Portfolio Loans

Solutions for borrowers with unique financial situations.

• Options for those with recent bankruptcy, short sale, or foreclosure

• Purchase or refinance available

• Tailored programs outside traditional lending guidelines

Reverse Mortgage Loans

A reverse mortgage allows homeowners age 62 or older to access the equity in their home through tax-free cash advances – with no monthly payments required during the loan term.

• Maintain ownership of your home

• No income or credit requirements

• Loan becomes due only when the borrower sells, moves out permanently, or passes away

• May qualify even with an existing first mortgage

👉 Find out if a Reverse Mortgage is right for you.

Complimentary Services to Support You Every Step of the Way

Working with My Lender Jackie and Summit Lending gives you access to valuable services – at no charge – to help you make informed decisions.

Pre-Qualifying for Purchase Transactions

• Fast 24-hour pre-approval from Jackie Barikhan

• Strengthen your offers with no financing contingencies

• Desktop Underwriting (DU) loan approval available prior to property selection

Title Information

• Property profiles and legal descriptions

• Current vesting, change of vesting, and trust vesting assistance

• Title discounts through major title companies

Credit Information

(with signed authorization)

• Complete tri-merge credit report with all three scores

• Guidance on correcting errors with major credit bureaus

Appraisal Assistance

• Access to detailed comparable listings to help determine property value for purchases, refinances, or estate planning

Appraisal Information

- Access to detailed comparable listings to help determine property value for purchases, refinances, or estate planning

Why Borrowers Choose My Lender Jackie

• Over 20 years of experience helping Californians achieve homeownership

• Expertise in self-employed and complex income scenarios

• Personalized service with a 5-star reputation on Google, Facebook, and Zillow

• Proven success closing Jumbo loans, bank statement programs, and stated income loans

Ready to explore your options?

Contact Jackie Barikhan at Summit Lending today for personalized guidance and a free consultation.

949-600-0944 or visit www.talkwithJackie.com to set up best time for you!