Hi, I’m Jackie!

If you’re seeking a luxury home loan paired with personalized, expert advice, you’re in the right place. I created this platform to help California’s most discerning homeowners and buyers make informed, confident lending decisions.

With over $500 million in closed loans and more than 20 years of experience, I’ve had the privilege of working with distinguished business leaders, tech innovators, A-list musicians, Star Athletes, top-tier medical professionals, and elite tradespeople.

Specialized Solutions for Self-Employed Borrowers

Traditional lending doesn’t always work for self-employed clients. That’s why my team specializes in alternative income loans, including bank statement , stated income and asset-based mortgages designed to meet your unique financial profile.

Our comprehensive suite of mortgage products ensures there’s an ideal solution for every client, whether you’re buying a luxury estate in LOS ANGELES, a beachside bungalow in SANTA BARBARA, a private equestrian retreat in SAN DIEGO COUNTY, a sophisticated midcentury property in PALM DESERT, a lucrative rental property opportunity in SAN BERNARDINO / RIVERSIDE Counties, or a coastal contemporary home in Orange County.

Why Work with Us?

- Tailored Lending Strategies: Custom solutions for high-net-worth and self-employed clients.

- White-Glove Service: Personalized guidance every step of the way.

- Proven Expertise: A trusted advisor in California’s luxury real estate market.

Ready to Elevate Your Home Financing Experience?

Contact me, JACKIE BARIKHAN, to explore the smartest lending options for your luxury property.

Let’s redefine what mortgage success looks like—together.

My Specialties

(click below for details)

Mortgages for Self-Employed

Game Changer! Bank Statements as Income

Stated-Income Home Loans

No Income Docs required

JUMBO HOME LOANS

Jumbo loan solutions at highly competitive rates

INVESTOR CASH FLOW

Cash flow loans vs. Tax Returns for Investment Properties

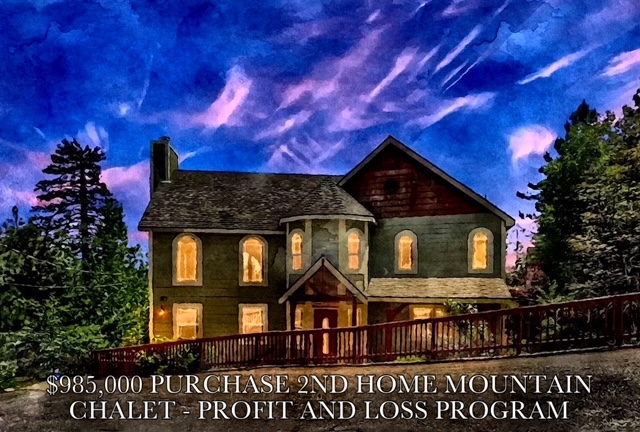

Recent Closings

DENIED A TRADITIONAL LOAN?

NO WORRIES..

WE CELEBRATE THE CREATIVITY & DETERMINATION OF OUR SELF-EMPLOYED PROFESSIONALS.

WITH FLEXIBLE LENDING OPTIONS, YOUR INCOME STORY CAN BE TOLD DIFFERENTLY.

UNLOCK CUSTOM LENDING SOLUTIONS THAT WORK WITH YOUR UNIQUE FINANCIAL PICTURE.

GIVE JACKIE A CALL AT 949-600-0944

VISIT WWW.TALKWITHJACKIE.COM TO SET A TIME THAT WORKS FOR YOU!

See What Others Are Saying

EXCITING UPDATES, EVENTS AND CONTESTS!

WIN A $100 AMAZON GIFT CARD!

2025 My Lender Jackie Photo/Video Contest

AS A COFFEE ENTHUSIAST, I’VE CRAFTED A FUN CONTEST FOR 2025.

REQUEST YOUR FREE MY LENDER JACKIE MUG, CAPTURE A PHOTO OR VIDEO OF YOU, YOUR KIDS OR EVEN YOUR FURRY BEST FRIENDS

ENJOYING IT. TAG US ON FACEBOOK/INSTAGRAM/X

@MYLENDERJACKIE

(SEE EXAMPLE OF OUR TOY POODLES PUPPIES… SO CUTE RIGHT!)

Every quarter in 2025

A RANDOM ENTRY WILL BE DRAWN AND WILL WIN A $100 AMAZON GIFT CARD!

Blog

How Interest-Only Mortgages Work for Luxury Home Buyers

When you're playing in the seven-figure real estate market, the standard 30-year fixed mortgage often feels like a blunt instrument. Traditional borrowers are usually focused on building equity as fast as possible, but for the affluent buyer, the math is different,...

What Credit Score Do You Really Need for a Jumbo Loan in 2026?

So, you’re looking at a luxury or high-end home, and suddenly someone drops the term jumbo loan, don’t freak out. It’s basically a mortgage that’s bigger than what Fannie Mae and Freddie Mac will back. If your home is in a pricey area like California or New York, or...

How High-Income W-2 Buyers Can Compete With Cash Offers in California

California’s housing market? Man, it’s insane. Prices are sky-high, competition is brutal, and yes, cash buyers usually have the leg up. Sellers love them because things close fast and there aren’t a ton of financing hoops. But if you’re a W-2 buyer making good money,...

Credit Score Myths in Luxury Lending

Credit scores matter in luxury lending just as much as they do in traditional lending, but not in the way that most high-net-worth borrowers assume. Many high-net-worth home buyers delay purchases, over-optimize their credit, or structure their finances inefficiently...