Recommended Professionals

Martin Wilson Realty One Group

Mission Viejo – Laguna Niguel

(949) 244-8753

Dave Feldberg

Coastal Group OC

3419 Via Lido #320

Newport Beach 949 371-8006

Cell #949 439-6288

Email: david@coastalgroupoc.com

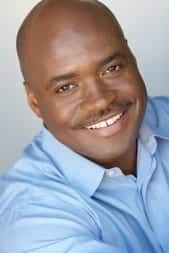

Kory Jackson

Kory Jackson

Keller Williams

8939 S. Sepulveda Blvd Suite 500

Los Angeles

310-256-3040 office

310-717-3720 cell

UNITED TAX SERVICE

2050 W. Chapman Ave. #216

Orange, California 92868

(949) 464-8776 office

(714) 366-2562 direct

(714) 242-9728 e-fax

Shawn McElderry

Shawn McElderry

Financial Advisor/CEO

Monarch Wealth & Retirement Strategies

(818) 370-9046 mobile

(855) 529-4015 toll-free

(866) 329-6977 fax

shawn.mcelderry@monarchwealth.com

When Does it Make Sense to Refinance?

A lot of clients come to me lately about a refinance. Is it a smart time to do a refinance and what kind of rates should you expect from a refinance right now? Sometimes the decision to refinance is based on a lot of different factors including interest rates, your...

Avoid Home Loan Pre-Approval Shaming

Being Pre-Approved is Your #1 Home Buying Preparation Tool Unless you are paying cash for a house it is imperative to get a mortgage pre-approval letter. What is this letter? A preapproval letter is a letter from your mortgage officer or bank, stating that you can...

How to Get Out of a HERO Loan

If you are looking for a pay off demand for your Hero Loan please go here: HERO Payoff Request Energy & EnvironmentalPhone: 800-969-4382HERO Payoff Website The term HERO stands for Home Energy Renovation Opportunity and is a government based program providing...

Can I Still Buy a Home with No Down Payment?

How to Buy a House with No Down Payment in 2019 In This Article You Will Learn: Types of No or Low Down Payment Loans If this loan is right for you Down Payment Assistance Eligibility First Time Buyers AND Repeat Buyers The down payment is usually the biggest barrier...

PACE- HERO – YGRENE Loans Failed to Help Homeowners

Government program! We can help you! Low income and no credit check – No problem! Almost sounds too good to be true, and then you discover that it is. Known as the Pace program, this increasingly popular form of home improvement financing is designed to help...

Kory Jackson

Kory Jackson Shawn McElderry

Shawn McElderry