Recommended Professionals

Martin Wilson Realty One Group

Mission Viejo – Laguna Niguel

(949) 244-8753

Dave Feldberg

Coastal Group OC

3419 Via Lido #320

Newport Beach 949 371-8006

Cell #949 439-6288

Email: david@coastalgroupoc.com

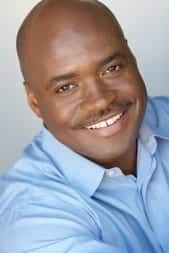

Kory Jackson

Kory Jackson

Keller Williams

8939 S. Sepulveda Blvd Suite 500

Los Angeles

310-256-3040 office

310-717-3720 cell

UNITED TAX SERVICE

2050 W. Chapman Ave. #216

Orange, California 92868

(949) 464-8776 office

(714) 366-2562 direct

(714) 242-9728 e-fax

Shawn McElderry

Shawn McElderry

Financial Advisor/CEO

Monarch Wealth & Retirement Strategies

(818) 370-9046 mobile

(855) 529-4015 toll-free

(866) 329-6977 fax

shawn.mcelderry@monarchwealth.com

What to Know About Buying a Fixer Upper as an Investment Property

Have you been wondering if buying a fixer upper is a smart investment move? When you realize the potential offered by real estate investing to build financial stability, generate passive income, and create generational wealth, it's only a matter of time before you...

How to Choose the Right Mortgage as a Real Estate Investor

When you decide to get into real estate investing, securing the right financing is a crucial step towards achieving success. The availability of various loan options can be overwhelming, especially for first time real estate investors. Choosing the right loan tailored...

Where to Look for an Investment Property

One of the best ways to combat inflation is to own real estate, and owning an investment property can provide even more safeguards to offset increased costs. If you are looking into buying your first real estate investment, one of the key factors you need to figure...

![Mortgage Backed Securities for Dummies – MBS 101 [2023]](https://mylenderjackie.com/wp-content/uploads/2023/11/Mortgage-Backed-Securities-for-Dummies-940x675.jpg)

Mortgage Backed Securities for Dummies – MBS 101 [2023]

Mortgage Backed Securities for Dummies (Just Kidding) - MBS 101 Let me share with you the several factors that influence Mortgage Backed Securities which determines what rate you will get. Timing the market for the best opportunity to lock a California mortgage rate...

Am I Ready for an Investment Property?

Building your passive income and creating a financial legacy are some of the many reasons people choose to buy an investment property. There is an extensive list of benefits associated with owning a rental property, whether you are house hacking a duplex, operating a...

Kory Jackson

Kory Jackson Shawn McElderry

Shawn McElderry