Recommended Professionals

Martin Wilson Realty One Group

Mission Viejo – Laguna Niguel

(949) 244-8753

Dave Feldberg

Coastal Group OC

3419 Via Lido #320

Newport Beach 949 371-8006

Cell #949 439-6288

Email: david@coastalgroupoc.com

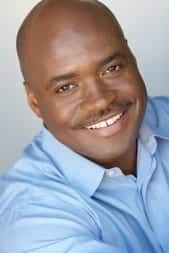

Kory Jackson

Kory Jackson

Keller Williams

8939 S. Sepulveda Blvd Suite 500

Los Angeles

310-256-3040 office

310-717-3720 cell

UNITED TAX SERVICE

2050 W. Chapman Ave. #216

Orange, California 92868

(949) 464-8776 office

(714) 366-2562 direct

(714) 242-9728 e-fax

Shawn McElderry

Shawn McElderry

Financial Advisor/CEO

Monarch Wealth & Retirement Strategies

(818) 370-9046 mobile

(855) 529-4015 toll-free

(866) 329-6977 fax

shawn.mcelderry@monarchwealth.com

Is the HERO Program a Good Idea?

The HERO Program is a Property Assessed Clean Energy Program provided by the Federal Government to provide financing for energy-efficient, water efficient, and renewable energy products to home and businesses in approved communities, specifically in California. This...

How Can I Raise My Credit Score Quickly?

If you search for quick fix credit repair on the Internet you're likely to get thousands of responses but surprisingly, it's not that quick to actually do the job. I get this question a lot and that's not surprising at all because most people want to improve their...

Secrets to a Great VA Home Loan

Anyone that has chosen to serve the USA through military services both presently and in the past is usually eligible for a VA loan. This loan is backed by the Veterans Affairs and is specifically reserved for those that have actively served. THANK YOU, BY THE WAY!!...

How to Do a Cash-Out Refinance on a Rental

You have a rental property. You don't want to give it up but you do want to refinance it because rates are low and you may have purchased the property when rates were high. Or, you're just looking to pull some money out of the rental property to either improve that...

When Should I Lock in a Mortgage Rate?

When is the right time to lock in a mortgage rate? This is an open-ended question. I've had people ask me when the best time is to lock in their rate even the best time of day or the day of the week. But the best time to lock in a mortgage is usually when the...

Kory Jackson

Kory Jackson Shawn McElderry

Shawn McElderry