by mylenderjackie | May 9, 2018 | Loan Approvals

It’s springtime! And there’s no better time to prepare to buy a house. Rates are still low, although they are creeping up, and there’s plenty of inventory. So you want to pull the trigger on a new home loan. Doing some research ahead of time will set...

by mylenderjackie | May 2, 2018 | Refinance Your Home Loan

Well, here we are, already into the month of May. Taxes are done and out of the way and now you might be thinking about refinancing or even buying another home. If a new mortgage or home loan is on the horizon for 2018, here are some things you can do now to set...

by mylenderjackie | Apr 24, 2018 | Loan Approvals

Self-employment – Entrepreneur. It means a lot of things and sometimes self-employed people think they may not be able to get a home loan because they don’t collect a W-2 and they think it might be impossible to prove their income. But this is not the...

by mylenderjackie | Apr 24, 2018 | Loan Approvals

We live in an age of button pushers and talking to our devices. With Google and Alexa we practically don’t have to do anything anymore. Just tell her what to do and if she’s connected, she can do it. So what about this RocketMortgage? On the surface, it...

by mylenderjackie | Apr 24, 2018 | Buying

The Urban Institute recently published a report discussing the obstacles to accessing homeownership. 80% of consumers either are unaware of how much lenders require for a down payment or believe all lenders require a down payment of over 5%. My job is to educate...

by mylenderjackie | Apr 24, 2018 | Credit

The last thing any buyer wants is to have their financing fall through before they closed on a new house. It’s tough enough these days to qualify for a mortgage so you don’t want to do anything that could damage your mortgage or upset your interest rates...

by mylenderjackie | Apr 24, 2018 | Blog

So you want to take your best friend out for a run and meet and greet with other furry friends here in the OC… Here are your Top 4 Best Dog Parks & Beaches in Orange County: 1. Laguna Beach Dog Park Nestled in Laguna Canyon, this park offers a fully...

by mylenderjackie | Apr 24, 2018 | Refinance Your Home Loan

I’m serious… there are really no downsides to the HECM reverse mortgage. I know some of you are going to say, sure, I’m a loan officer, I’m naturally going to say that, but honestly, this program has got a bad rap and I’m not exactly sure...

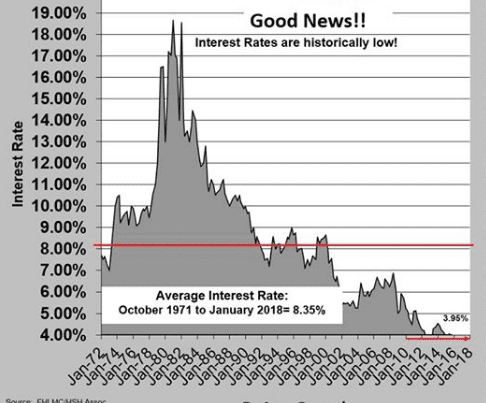

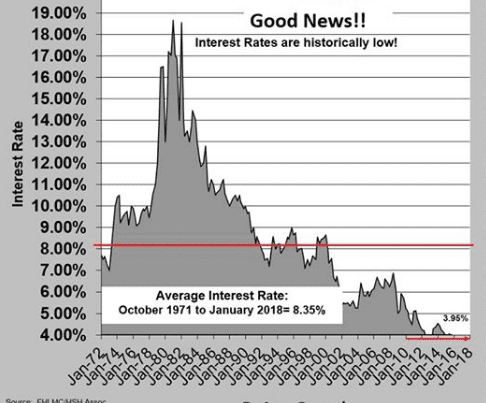

by mylenderjackie | Apr 24, 2018 | Blog

Good News! Interest Rates are Still Historically Low- 2018! Take a look at this chart below… for those of you panicking because interest rates will eventually hit 6%. Please realize that we are still way below the average rate of the last 47 years at 8.35% If...

by mylenderjackie | Apr 24, 2018 | Blog

Many Americans are on edge wondering what this new tax plan may entail and how it will affect them personally. California homeowners especially are curious, and some are a bit anxious as to how these new laws affect homeownership and the real estate market in...